If you’re looking for insurance, you’re probably interested in lowering your auto insurance rates. Have you ever wondered how auto insurance rates are determined? Well, you’re not alone. We answer this question almost daily.

If you’re looking for insurance, you’re probably interested in lowering your auto insurance rates. Have you ever wondered how auto insurance rates are determined? Well, you’re not alone. We answer this question almost daily.

Insurance companies must balance rates with the cost to cover claims. Factors that may affect the cost of your policy:

- Accident history

- Driving record

- Vehicle make and model

- Annual mileage

- Vehicle Usage

- Your credit- based insurance score

- Your age and eligibility for discounts

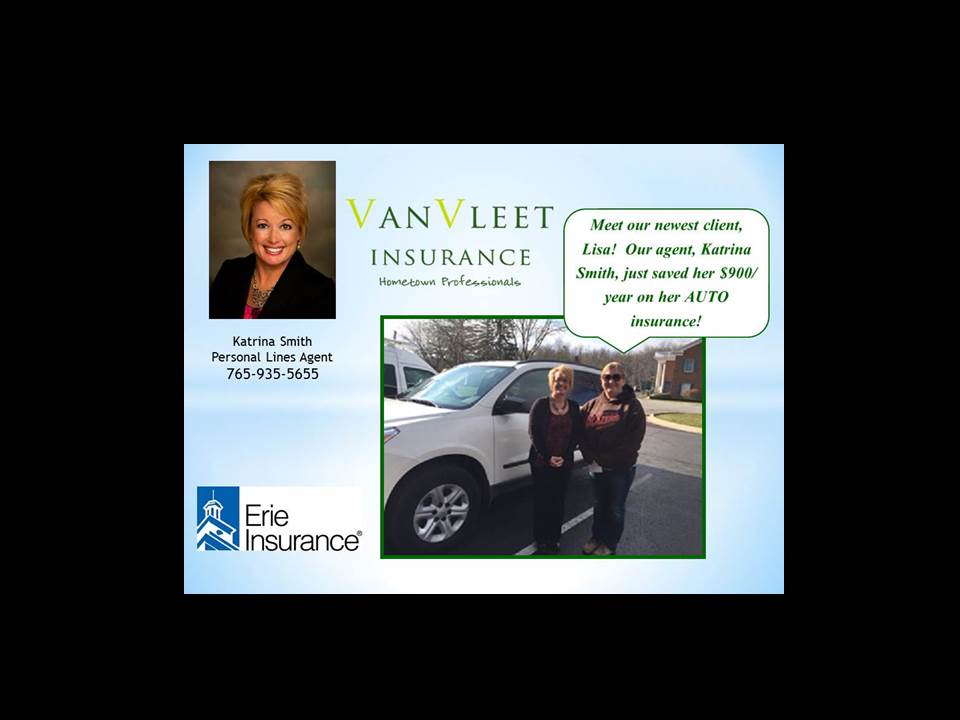

We represent Erie Insurance in Indiana, Ohio, and Kentucky. Auto insurance rates also vary by state too. Rates in any given state are based in part on historical claim frequency and repair costs for car accidents or theft, as well as other factors like the cost of medical care. Within a state, some territories have higher rates than others. To summarize, there are a lot of things that factor the cost of your auto insurance. We would greatly appreciate the opportunity to review your auto insurance with you. Call our office today to set up an appointment!